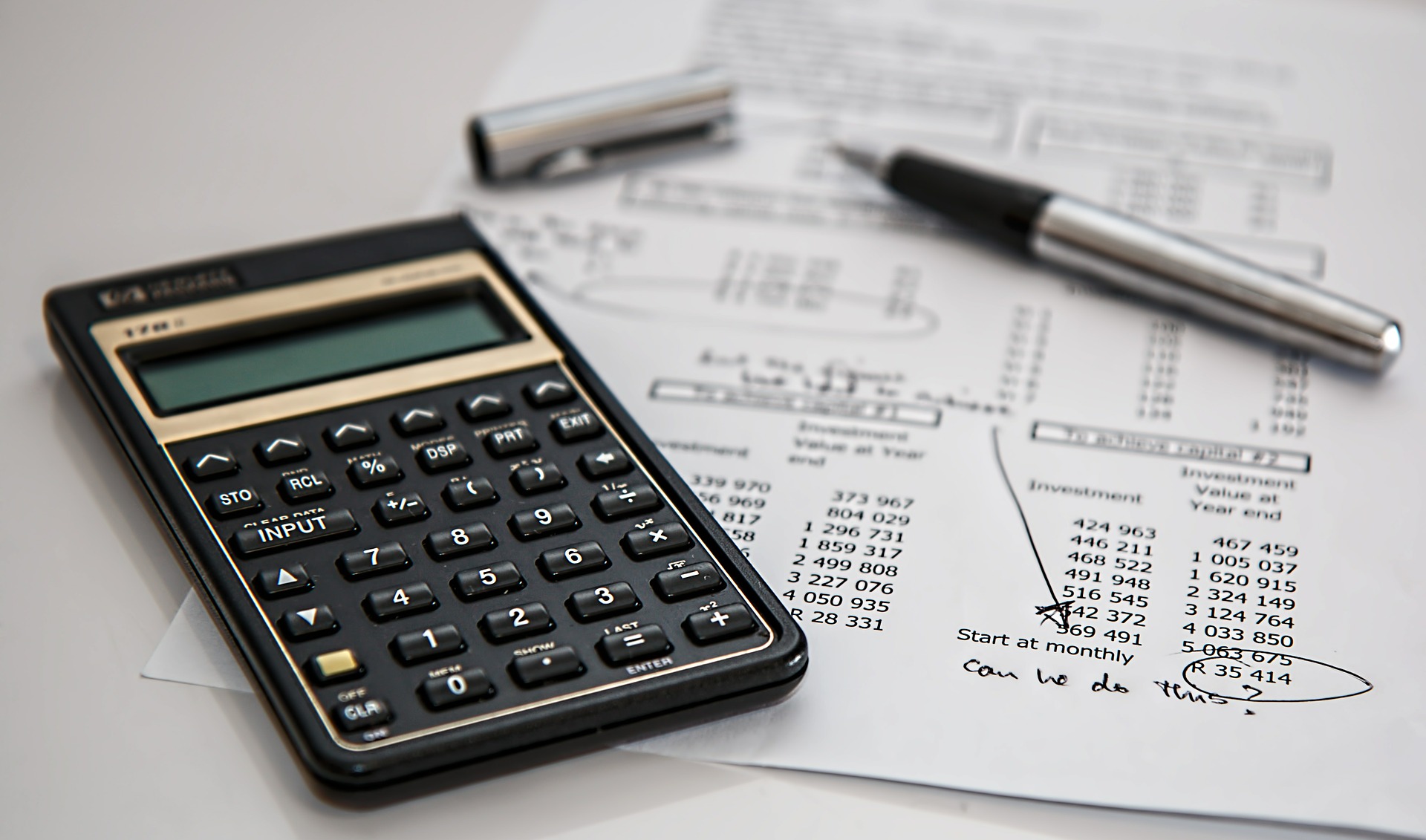

The deadline for individuals to lodge their tax return is Saturday 31 October and people who miss the deadline could face up to a $1,110 fine.

While for some tax time is daunting, Chartered Accountants have put together some key tips to ensure that trick-or-treaters are the only scary thing this Halloween.

1. Know the Deadline Date and gather information

“It may seem obvious, but the crucial date individuals need to know is 31 October, which is the tax return due date if you’re lodging your tax return yourself,” Chartered Accountants Australia and New Zealand Senior Tax Advocate Susan Franks said.

The ATO will have pre-filled a lot of information in your tax return that you’ll need to confirm – such as salary and wages, interest and dividend income, medical insurance and bank account details to send your refund to.

Before you lodge, you should have your tax file number, income sources, bank account details, Medicare information on hand and, if you are married, details of your spouse’s taxable income.

You should also have records supporting any deductions that you are claiming.

2. The Deadline Extension Loophole

“While individual tax returns are due on 31 October, if you are lodging through an accountant you will be entitled to a longer period – subject to your lodgment history,” Franks said.

To be eligible for the extension you need to see an accountant prior to 31 October, and remember, the cost for this is completely tax deductible.

3. Report All Income

“It’s vital you declare all your income. Any income received from second jobs will also need to be reported, as well as any Government payments,” Franks said.

“This includes money earnt from providing ride sharing or accommodation services.”

The Australian Tax Office receives information about these payments so ensure that you report them in your tax return to avoid questioning from the ATO.

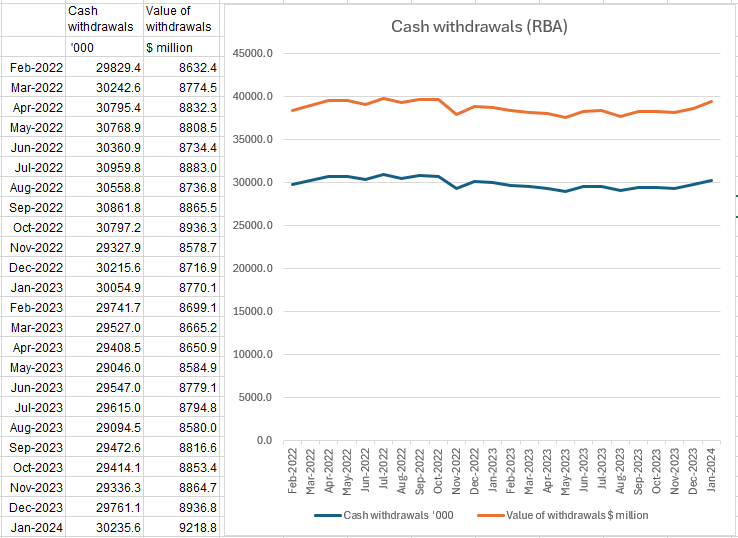

4. Low Interest Payment Plans

“For those struggling to find the cash to pay their tax, there is the option of engaging in a tax debt payment plan with the ATO, to help you pay existing and ongoing tax liabilities,” Franks said.

Anyone struggling with the financial impact of COVID-19 should discuss this with the ATO, or your accountant.

5. Still Miss the Tax Return Deadline?

“If for whatever reason life gets in the way and you miss the deadline, the important thing to do is to speak with the ATO as soon as possible,” Franks said.

“Your Chartered Accountant can help facilitate contact with the ATO and can help get your tax return in quickly to help you avoid accumulating more late penalties.”