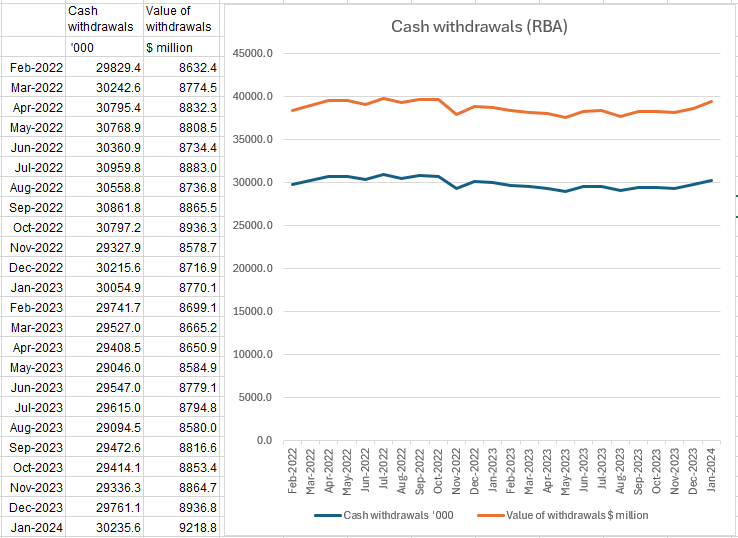

One of the first things on many expat pensioners minds will be the reduction in the value of the UK pound in terms of the Australian dollars.

On September 23 the pound dropped like a stone to $1.65 following the UK mini budget.

Those of you who are on an Australian Pension can claim an extra 50¢ in the dollar for every reduction of payment from the UK, so it is not totally bad news.

The latest serious blunder from the UK pensions is that many people are not receiving their full pension entitlement because the Department of Works and Pensions (DWP) have not included years of family responsibilities in the number of qualifying years towards a UK State Pension.

Some people – mostly mothers – were not getting this protection because of problems getting data from the Child Benefit Computer onto the National Insurance computer. DWP ran a correction exercise over a decade ago which identified around 36,000 parents who had wrongly missed out and it paid over £85m in state pension arrears, as well as increasing weekly state pensions for those affected by an average of £10 per week. Now DWP thinks more people may be missing out.

So what can someone, in Australia, who thinks that they might have missed out do about it?

The important criteria is that a person should have been receiving the Child Benefits (before 2010 called HRP) in their own name for a child under age 16 (for the whole of the year) and not been paying a Married Women’s (or reduced) Stamp.

Check your National Insurance record. You can ring the National Insurance Contributions helpline which from Australia is 00 11 44 191 203 7010 and ask to be put through to ‘National Insurance record or payments’. You will need your National Insurance Number and will be asked some security questions.

They can post you a copy of your full record for you to check whether the years that you were claiming Child Benefit are included as full contribution years.

If you are missing years, you can fill in a simple form that can be downloaded or filled in on the computer with details of your child or children and if you are entitled the UK government should update your record.

If a Child Benefit record is missing from your NI record because it was in your husband or partner’s name and case and they don’t need the Child Benefit, because they were in employment and paying NI, then you may be able to get it transferred to you, provided that you have reached UK State Pension Age being born after April 5, 1948.

N.B. if you are calling the UK the office opens at 15.00 hrs WA time and after October 29 16.00 hrs.

Am I UK State Pension Age?

UK Expats and Australian citizens born between October 6, 1954 and April 5, 1960, who have worked for a minimum of 10 years in the UK, will be eligible to claim their UK State Pensions from their 66th birthday.

The age that those born after April 6, 1960 can claim will increase by one month extra for every additional month of birth until March 6, 1961 when it will become their 67th birthday. This is now subject to a UK Government review due next year.

Anyone who would like to discuss their options on any aspects of their UK State Pensions, is welcome to contact Mike Goodall

on 0403 909 865 or via e-mail mikecgoodall@btconnect.com.